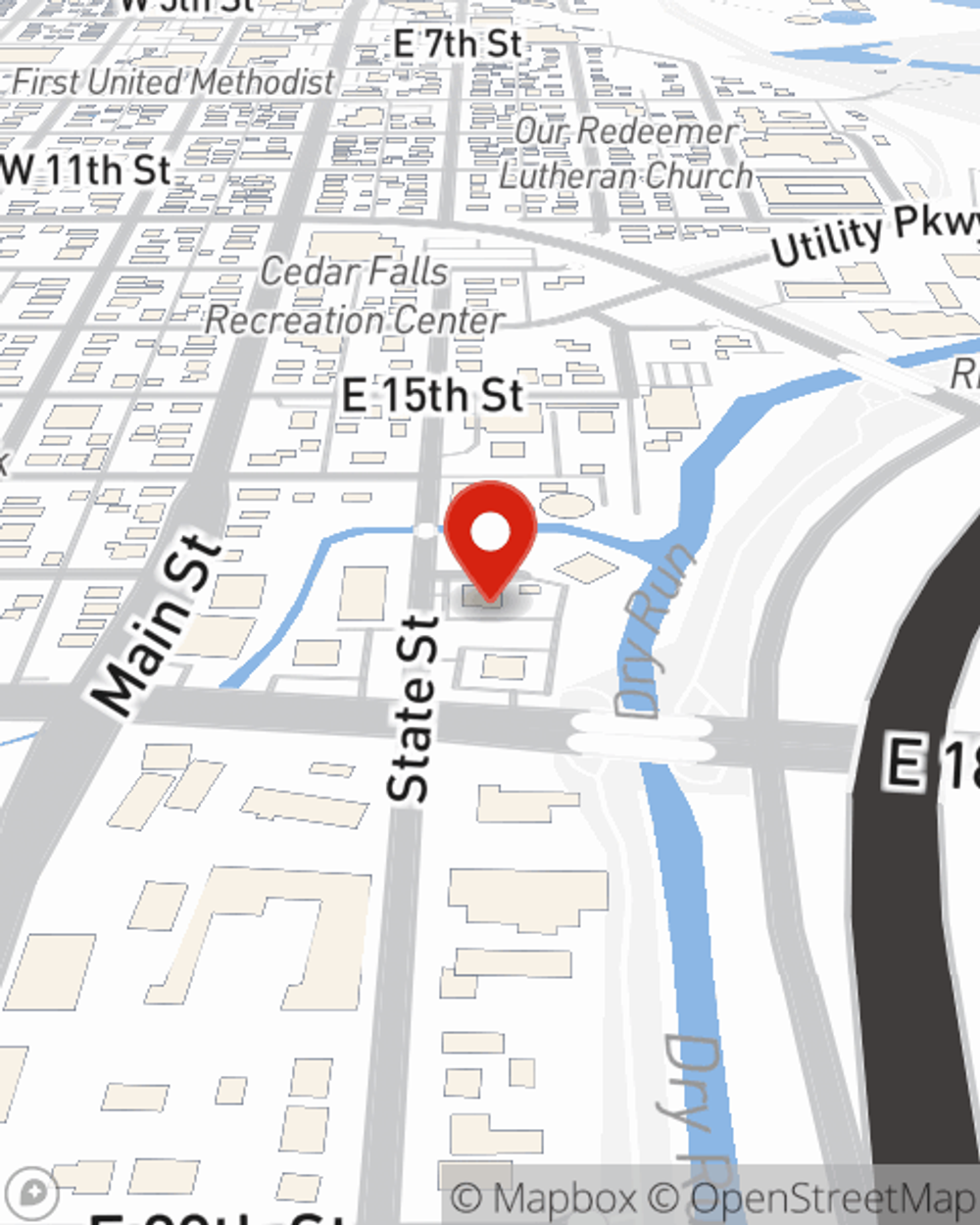

Life Insurance in and around Cedar Falls

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Black Hawk County

- Cedar Falls

- Waterloo

- Des Moines

- West Des Moines

- Cedar Rapids

- Iowa City

- Ames

- Cedar Valley

- Waverly

- Sioux Center

- Sioux City

- Davenport

- Quad Cities

- Dubuque

- Decorah

- Mason City

- Hudson

It's Never Too Soon For Life Insurance

If you are young and newly married, it's the perfect time to talk with State Farm Agent Brad McCunniff about life insurance. That's because once you buy a home or condo, you'll want to be ready if tragedy strikes.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Put Those Worries To Rest

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With coverage options from State Farm, you can lock in terrific costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Brad McCunniff or one of their caring representatives. Brad McCunniff can help design coverage options adjusted to fit coverage you have in mind.

No matter what place you're at in life, you're still a person who could need life insurance. Visit State Farm agent Brad McCunniff's office to discover the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call Brad at (319) 266-7533 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Brad McCunniff

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.